January 30, 2025

Brand matters

Our 2024 Global Top 50 P&C Re Brand Rankings highlight the differentiated brand experience of reinsurers, offering...

Reinsurers have found a new source of strategic leverage — and it is digital. As their platforms mature into full-scale risk solutions, they are not just supporting underwriting. They are starting to shape how reinsurance is placed, priced, and grown.

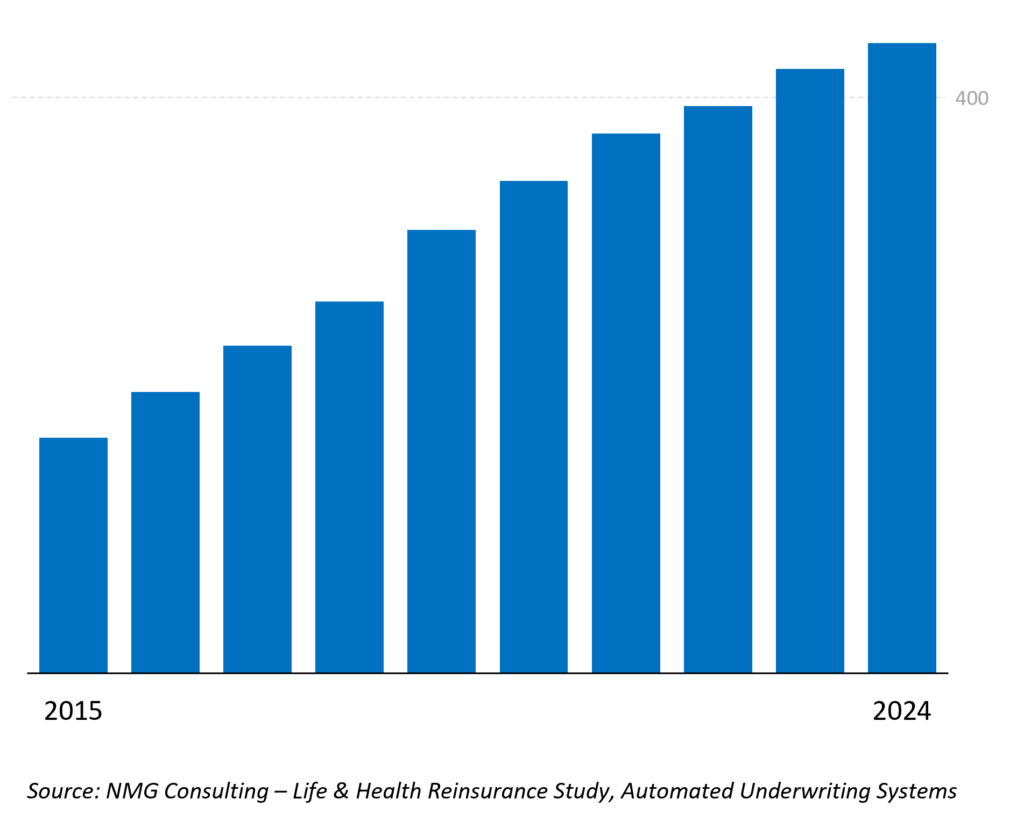

At the close of 2024, nearly 450 reinsurer-owned automated underwriting platforms are live globally — a dramatic rise from 2017, and more than half of all active systems worldwide. This growth unfolded through a pandemic, with reinsurer platforms proving both scalable and durable.

Exhibit 1: The ascent of reinsurer-owned systems

Number of automated underwriting sites – reinsurer systems – global

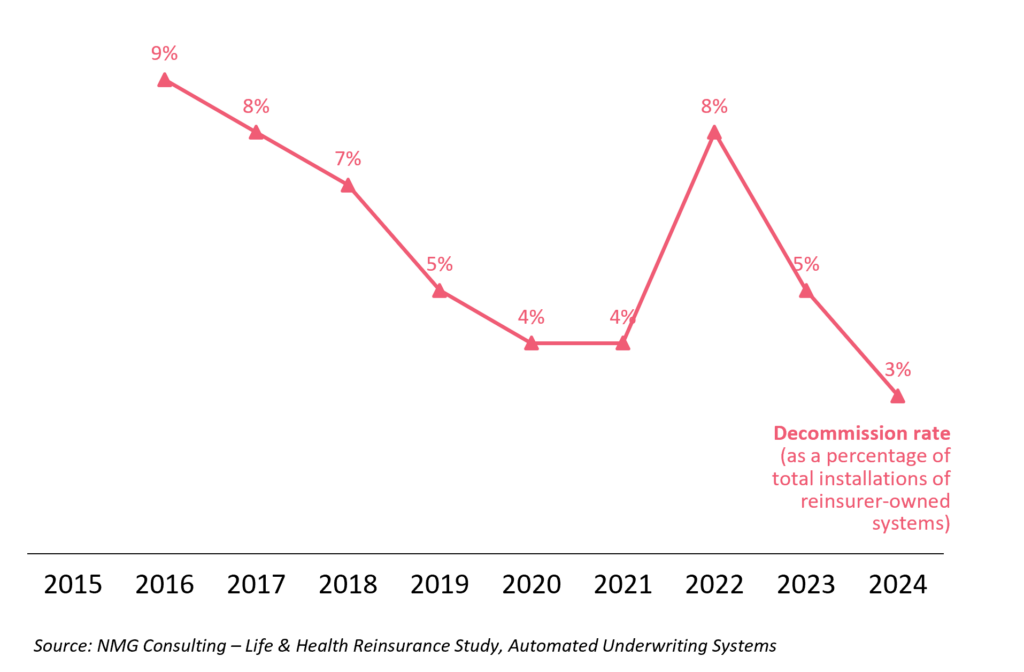

While new installations slowed in 2023, so too did platform decommission — a sign of their entrenched role in underwriting ecosystems. Switching costs remain high, and platform “stickiness” continues to favour incumbents. Reinsurers are now well-positioned for supplemental installs, greenfield builds, in-house replacements, and distribution integrations.

Exhibit 2: Falling decommission rates

Profile of new installations – Reinsurer AUS (2021-2024)

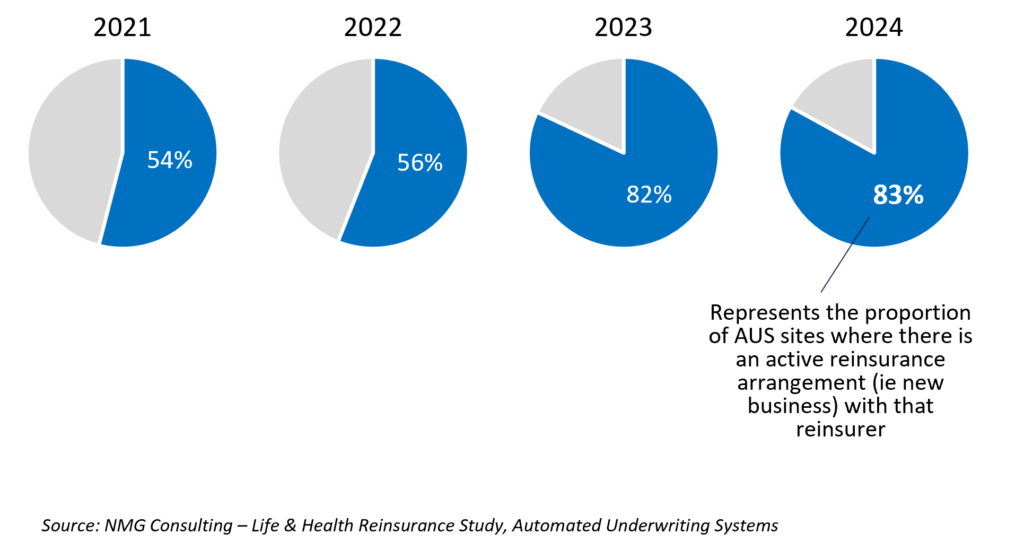

Reinsurer platforms are steadily evolving into full-scale Digital Risk Solutions — a shift that opens doors to deeper strategic partnerships beyond traditional fee-for-service models. These solutions align more closely with core reinsurance offerings and carry potential to directly influence premium flows.

Meanwhile, tech sector interest has cooled — constrained by limited underwriting access, no proprietary IP, and an inability to carry risk.

In our assessment, the scope of opportunity for each competitor depends on factors that include:

Exhibit 3: New installations increasingly aligned with reinsurance placement

Proportion of aligned new installations – Reinsurer AUS (2021-2024)

The real story? Reinsurer-owned platforms are steadily evolving into broader suites of Digital Risk Solutions — with the potential to move beyond fee-based tech plays into strategic partnerships aligned with core reinsurance offerings. Competitors possessing all three — a strong franchise, quality client portfolio, and a capable digital risk platform — have the potential to significantly reshape their reinsurance propositions over time. For others, the opportunity remains to pursue niche applications that enhance client outcomes and grow reinsurance premiums in the process.